The Chancellor’s recent Plan for Growth is a house full of horrors for landlords, warns TaxationWeb’s Lee Sharpe.

Introduction

The Chancellor’s recent 2022 Prayer for Growth has both brought forward the Basic Rate reduction to 2023/24, and triggered eye-watering rises in mortgage interest rates – although it seems the Chancellor is a little bashful about taking the credit for all the things he has managed to achieve in such an astonishingly short space of time.

So far, residential property landlords paying Income Tax on their rental profits, and their advisers, may have been concentrating on mortgage rates, which started rising almost as soon as the Chancellor finished speaking. Some landlords will be protected for a while from the worst effects of the Chancellor’s Plan because they are on fixed deals. But even his promise to bring forwards the 1% reduction in the Basic Rate is not as welcome as it might first appear – at least for landlords subject to Income Tax. And it cannot be postponed.

BTL Finance Restriction Mechanism – Recap

Landlords in business on their own account will generally be subject to Income Tax and should be familiar with the special regime for disallowing the finance costs on “dwelling-related loans” – broadly, mortgage interest on “Buy-to-Lets” (“BTLs”). Setting aside the rationale for the measure, the tax mechanism is simple, in principle:

- Disallow the mortgage interest: tax the landlord (landlady, if you prefer) as if their residential letting profits had not suffered any finance costs – even if this puts them into the 40% Income Tax band (or 45%, for that matter). Or it means higher student loan repayments, clawback of Child Benefit, etc., etc.

- After their tax has been calculated, reduce that tax liability by the disallowed interest x the Basic Rate of 20%. (This part of the mechanism can actually become quite involved in some scenarios).

Anyhew, in the Spirit of imminent All Hallows Eve, for our contrived illustrative scenarios we are going to delve into a purely fictional world, based entirely on fictional events that never happened, and populated by characters (and organisations or entities), the similarity of whom (or which) to actual persons, (or organisations or entities), living or dead, (or somewhere in between), past or present, is purely coincidental…

The 1% Basic Rate Reduction for Non-Landlords and Landlords

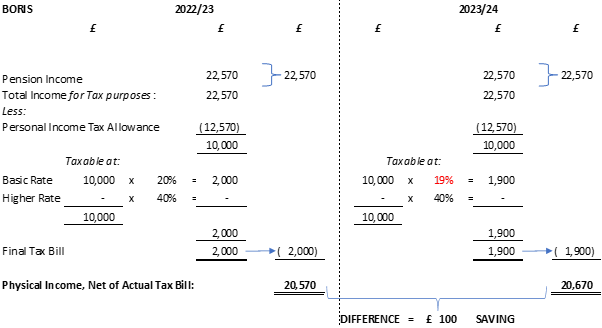

Boris - Pensioner

Boris, who has recently retired, receives total pension income of £22,570 a year. He is pleased by the Chancellor’s promise to reduce the Basic Rate of Income Tax, because it will reduce his personal tax bill by £100 in 2023/24:

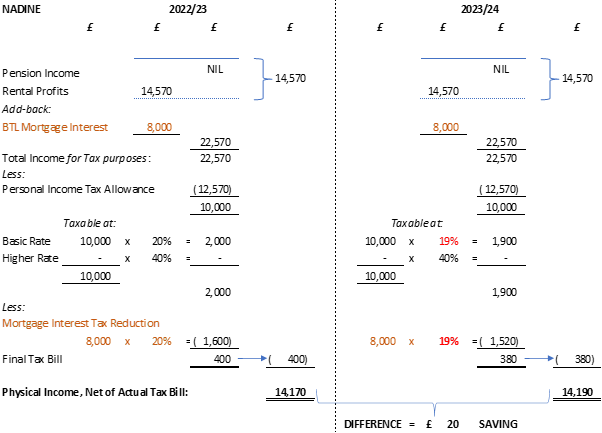

Nadine – Landlady

Boris’ best buddy Nadine is a landlady with a few BTL properties. After all the landlord-related tax adjustments, she has the same total income for tax purposes as Boris, so she is also looking forwards to saving £100 in tax. But she will be disappointed.

Nadine has hit the first small pothole for landlords, implicit in a reduced Basic Rate of tax: it reduces the value of the tax “credit” (reduction) as well, so no tax saving accrues to the artificial interest adjustment, that is both taxed and relieved at 19% (ITTOIA 2005 s 274AA (5)). Nadine does save some tax but only on part of her “real” income of £14,570 – which is notably lower than Boris’. Now so far, so fair: Nadine’s real net income from property is much lower than Boris’ pension, and the landlord interest adjustments have cost her nothing, but saved her nothing.

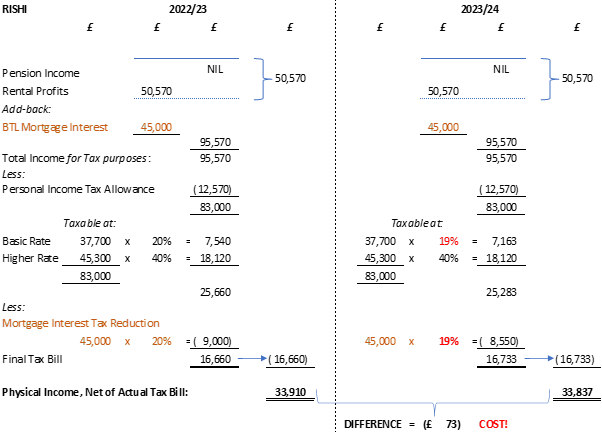

Rishi – Landlord

But Nadine has it easier in some respects than her close friend Rishi, who has a larger portfolio – but also has higher lifestyle costs – include a burgeoning fancy footwear habit that is, frankly, getting a little bit out of control:

We have graduated from small potholes to minor speed-bumps: Rishi is still being taxed at 40% on his artificially-disallowed income, but the saving from the Basic Rate reduction has fallen, because it is now worth only 19% – his Marginal Income Tax rate has increased from 20% to 21%!

(In fact, Rishi has benefited a little from the 1% reduction in the tax on his “real” rental income: it’s just been buried under the extra 1% cost in 2023/24 from the mortgage interest being taxed at 40% against 19% and not 20% any more.)

As an aside, any landlord who has not yet been able to use all of their Relievable Amount up to 2023/24 (basically because their mortgage interest costs have been so high, they’ve not been able to get the full credit in-year, so it is carried forwards) will see any Relievable Amount accumulated so far, de-value overnight come 6 April 2023, as well. Fun times; but even funner times ahead, when we look at the effect of rising interest rates.

Considering Interest Rate Rises

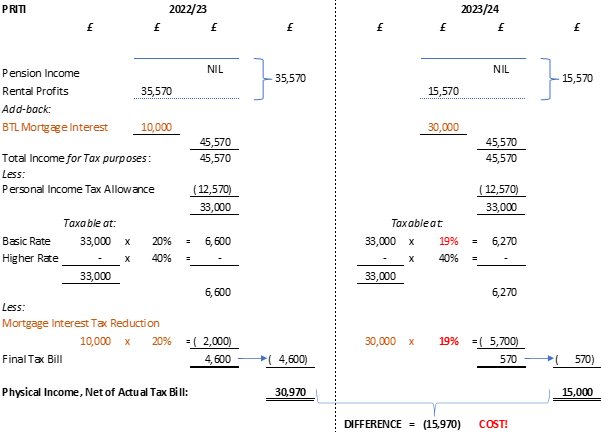

Priti – Landlady with Rate Rises

Whether they believe it or not, both Nadine and Rishi have been lucky up to now: they’re both on fixed-rate mortgages, so the increase in mortgage interest rates has not affected them in 2023/24. Poor pal Priti’s mortgage arrangements came off their 2% fixed rates on 6 April 2023, (conveniently for us), so her interest costs have immediately trebled to 6% in 2023/24 – but all of her tenants are on fixed tenancy agreements until 5 April 2024 and beyond, so she cannot put up her rents!

Poor Priti has suffered a £20,000 increase to her interest costs, so her real rental profits have in turn fallen by £20,000. Her total income for tax purposes has not moved, of course, because the lost income is balanced by disallowed interest costs (however, those increased taxable interest costs are in turn balanced by the 19% tax “credit” interest adjustment at the end). Now, Priti could be a little bit upset by seeing her real net-of-tax income halved in just 12 months, but at least she has saved some real tax: her “real” rental profits in 2023/24 of £15,570 – net of the £12,570 Personal Allowance – have been taxed at only 19% in 2023/24, effectively saving her £3,000 @ 1% = £30. Cheer up, Priti, you’ve saved £30!

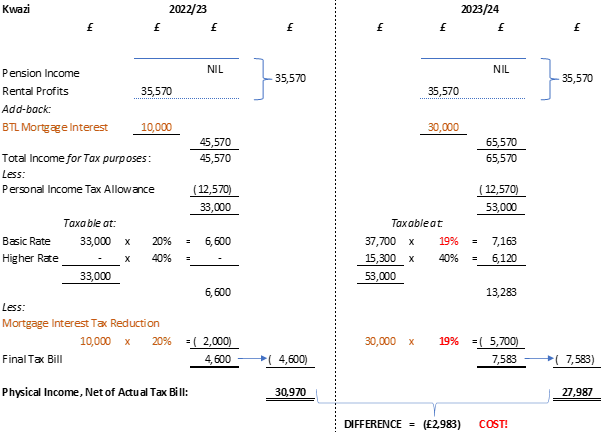

Kwazi – Landlord with Rate Rises But Increased Rents

Clever Kwazi considers himself both bright, hard-working and lucky, which is a fine combination if you can manage it. Lucky Kwazi happened to attend a séance at a swanky soirée held by some sophisticated investment banker pals and they were able to channel the ghost of a former Chancellor of the Exchequer, no less: she spoke in tongues for most of the night about “unfunded tax cuts”, but clever Kwazi was nevertheless able to divine from those nonsensical ramblings a profound sense that Sterling would suddenly tank, and interest rates promptly sky-rocket, albeit not directly from anything he could definitively put his finger on. Clever Kwazi soon realised the implications for landlords such as he, and with a lot of hard work on Kwazi’s part, his letting agent was able to negotiate rent rises with his tenants from 6 April 2023 to exactly offset his interest costs – well done, Kwazi!

(Actually, although he’s too modest to admit it, Kwazi was rather lucky again because, in this story, all his tenants are Shamazon delivery drivers. And, in this wholly fictional story, Shamazon has increased its annual subscription fee by almost 13% this year to cover its rising costs; surely those rising costs can really only have been to increase funding to pay for local delivery drivers, seeing as – in this story – Shamazon is fundamentally a software-based order fulfilment company, whose monolithically valuable intellectual property has been secured in a haven far removed from the mundane tribulations of double-digit inflation. Anyway, back to those Shamazon delivery drivers: they’re loaded, and can easily afford to see their personal rents increase by a mere c40% or so.)

Oh, no! What has happened? Kwasi has come unstuck! He forgot that increasing his rents to cover the extra interest cost would also increase his net tax liability because, even though he has really only ‘earned’ £35,570 just like in 2022/23, he suffers Higher Rate Tax as if his income for tax purposes has now taken him well above the Higher Rate Threshold. And that Basic Rate tax reduction for interest only covers 19% of the 40% exposure, leaving him c£3,000 worse off. This may seem like only a small amount of money but it is actually almost a tenth of his net income and, as prices and interest rates continue to rise, he finds he can no longer repay both his own mortgage and those on his rental portfolio.

But it gets worse. Ordinarily, Kwasi would work hard to find a more competitive mortgage rate, to save himself some interest and get back on an even keel. But for some reason, many lenders have withdrawn products from the market, and those that are left have much more stringent lending criteria – something to do with less fortunate investors not being able to make their mortgage repayments, and a significant rise in potential defaults forcing lenders to push rates up even higher. And to cap it all, Kwasi’s tenants refuse to take another rent increase this year – not even 10%! Things are not looking good for Kwasi: no matter how hard he works, no matter how hard he thinks it through, he just cannot see a way out of his dilemma…

Thank goodness this was only a dream. Because, in the real world, that purely artificial increase in taxable income could trigger a clawback of all of your/your partner’s Child Benefits in the tax year, plus increases to Student Loan repayments, Post-Graduate Loans, reduction in so-called “Savings Allowance”…not so much a speed bump as a sinkhole.

Small and Imperfectly Formed

It seems that few property specialists have seen fit to point out the small sting in the tail lurking for BTL landlords, when the Basic Rate of tax falls from 20% to 19%. I have not seen mention of it outside of our response to the original announcement in the March 2022 Spring Statement. Some may say that the amounts involved are too small to worry about. But others may want to trace and reconcile the differences.

Given our previous dealings with HMRC over the introduction of the landlord interest regime and the weaknesses in the original legislation, it would not surprise me to find that even the government had missed the consequences peculiar to landlords.

While it is understandable that the 1% reduction in the Basic Rate may be welcomed by many taxpayers, we have already covered the effects of “fiscal drag” – where things like the Personal Allowance and Higher Rate Tax Threshold are deliberately held static by the Government for several years against rising incomes (inflation), thereby significantly increasing tax revenues without seeming to try. When we published the calculations assuming a 10% rate of annual inflation, I wondered if people might scoff at such alarmist nonsense. I’d rather we’d been more wrong: the amounts required just to stand still in real terms, while inflation is running at 10% annually, make the £150 or £200 that many will save from the Basic Rate tax cut each year seem positively tawdry.

A Worrying Picture

The much bigger issue is the effect of rising interest rates on the interest restriction mechanism. The mechanism was conceived at a time when interest rates were very low, and finance was cheaply and readily available. Now, interest rates been turbo-charged and their cost – and consequently the tax disallowances – are set to rise dramatically. Landlords with fixed terms may have more time to adapt their business model but others may have to think fast, or suffer much higher tax bills.

It seems likely that many real-life landlords who hold more than one or two properties subject to mortgage are at some stage going to find themselves dangling precariously between the examples of “Priti” and “Kwazi” above: significant increases to their real interest costs being artificially exacerbated by the tax treatment, and the only way out of the dilemma in the short term being to try to push up the rents they charge. Mathematically, these increases may act as a “force multiplier” to inflationary, and ultimately to further interest, pressures. Where the landlord’s interest costs are significant, modest rent increases of 6% will not put a dent in the mortgage repayments.

For the Exchequer, it seems, the landlords’ interest restriction is a gift that just keeps on giving. I suspect it was launched on a specious, politically-motivated argument that it somehow made things fairer to everyone else by making landlords pay more tax …on their legitimate business expenses… unlike practically any other business – thus spake Gideon, in his 2015 Summer Budget:

“Buy-to-Let landlords have a huge advantage in the market as they can offset their mortgage interest payments against their income, whereas homebuyers cannot.

And the better-off the landlord, the more tax relief they get.

For the wealthiest, every pound of mortgage interest costs they incur, they get 45p back from the taxpayer.

All this has contributed to the rapid growth in [the prevalence of] Buy-to-Let properties, which now account for over 15% of new mortgages, something the Bank of England warned us last week could pose a risk to our financial stability.”

Where Now?

Now in 2022, I rather think that the mortgage interest tax restriction for BTL landlords is a solution looking for a problem that, if it ever actually existed, died of natural causes some time ago (technically, I think the BoE’s Prudential Regulation Authority has since managed the risk, using a completely different set of tools, from 2016 onwards). Either way, I read that the Bank of England has bigger fish to fry right now than the Buy-To-Let market. It has been reported that roughly half of all mortgage products were recently withdrawn, and the prevailing concern over property appears to be the risk of a housing market crash, rather than its overheating.

I have always struggled with the idea that the regime was anything more than a money-grabbing exercise lightly clad in politically expedient fluff. Given that the regime applies equally to finance costs on lettings anywhere in the world, not just properties in the UK, are we really supposed to believe that George Osborne, aka the Angel of Austerity, cared so deeply about the aspiring would-be homeowners of Naples and Vladivostok, that he was moved to disadvantage UK landlords living in Cornwall or Liverpool? Pull the other one.

Perhaps now would be the right time for the kind of tax simplifications that do not, in fact, have tax-raising as one of their main objectives? Maybe time to kill off a wholly artificial regime that was superseded in its stated aim almost immediately, and whose retention seems intended primarily to swell the coffers of the Exchequer..?

Please register or log in to add comments.

There are not comments added