TaxationWeb's Lee Sharpe looks at the 2024 Spring Budget, and considers the tax implications for self-employed taxpayers, and family companies paying dividends versus salary.

Introduction

I might characterise the Chancellor’s Speech as somewhat akin to having to pick up a mangy cat. There’s stuff in there not to like, but the ground could have been salted much worse. The frequency and the amplitude of politicisation was… disappointing. Such point-scoring, if well-made, is tolerable – entertaining, even – but the sad fact is that the only moment of genuine levity was provided by the Leader of the Opposition, when he referred to the Chancellor and his boss as “The Chuckle Brothers of Decline” – I’ve not laughed like that over Budget commentary since something David Whiscombe wrote, many more years ago than I’d care to number.

Links to key documents / pages follow.

Spring Budget 2024 HM Treasury Documents including Red Book

Spring Budget 2024 Tax-Related Documents

Spring Budget 2024 – Chancellor’s Speech

General

Alcohol Duty Freeze – welcome news for drinks and hospitality businesses, but perhaps not as welcome as a return to pandemic-era reduced rates of VAT, for which, it seems. many hospitality businesses are desperate.

Excise Duties – Vaping is bad, apparently, so now needs an Excise Duty. But it’s still much better than smoking, so smoking needs even more Excise Duty, just to maintain the point. And this is nothing to do with HM Treasury worrying that Excise revenues will fall as people migrate from smoking to vaping. Both measures come in from October 2026. It is good to see that HM Treasury has no qualms about accusations of “nanny-statism” when there’s more than £1.3billion in tax to be raised by 2028/29.

UK ISA – extending ISA provision by £5,000pa for UK equities. Given the comparatively low take-up of existing ISAs in their entirety, I smell a “Brexit Bonus” that is too embarrassed to speak its name.

Fuel Duty and Motoring Costs – The Chancellor has frozen Fuel Duty again – the 5p cut in rates has been extended, and there will be no RPI-linked increase to the duty in 2024/25. While this is a very expensive measure according to Table 5.1 of the Red Book, employees using their own car for work in particular should stow their gratitude, because there is still no change to the mileage rates that they are allowed to claim (or be reimbursed) when using their car for work.

A quick reminder:

- In 2002, employees lost their fundamental right to claim for the real motoring costs they actually incurred, to make HMRC’s life easier (it couldn’t keep up with all the paperwork generated by formal claims)

- Since then, employees can only be reimbursed (or claim) at the official mileage rates – simple, but inaccurate

- Those rates have remained essentially unchanged since before 2002

- The actual cost of motoring has basically doubled since then, according to the Government’s official figures

The regime as it now stands is grossly unfair to employees: they have no choice but to use rates that fall woefully short of their real costs. Simplification the way HMRC likes it.

We wrote about this quite extensively in 2022 and nothing has changed, except the actual costs of motoring have gotten worse. Self-employed people should not ignore this issue completely, because the same rates are used for the motoring part of their simplified expenses regime – although self-employed people do still retain the option to make a claim for actual motoring expenses instead.

While not tax-oriented, there are also measures to:

- Make Universal Credit Advance Loans repayable over 24 months instead of 12, and

- Remove the £90 charge for a Debt Relief Order

Personal Tax

High Income Child Benefit Charge to Start at £60k of adjusted net income and be withdrawn more slowly, over the next £20,000 of income (rather than just £10,000 as now). Long overdue, this woefully ill-conceived measure is finally being acknowledged as “confusing and unfair”, with the extension taking effect from 6 April 2024. But the Chancellor is suggesting that it would be fairer to gauge Child Benefit entitlement (and how much should be clawed back) across the household as a unit by April 2026 – AGREE-ish – and proposes to get HMRC to “collect household-level information” for this purpose – FULSOMELY DISAGREE. HMRC is already awash with more data than it knows what to do with. I have precisely no confidence whatever that HMRC could be entrusted to apply its data and processes to manage the monitoring of income by household, without its all turning into the kind of train wreck that can be seen from space.

Domicile Remittance Basis Regime Abolished – Apropos of nothing, the Chancellor has concluded that actually, favouring non-domiciled individuals (at least in terms of their non-UK wealth) does little to encourage inward investment after all so, starting 6 April 2025, Individuals who opt into the new regime will not pay UK tax on any foreign income and gains arising in their first four years of tax residence, provided they have been non-tax resident for the last 10 years. There will of course be numerous transitional adjustments, such as re-basing and a two-year window to avail oneself of a 12% tax charge on introducing foreign income to the UK. According to the figures, it is by far the largest single tax-raising measure in the Budget, (Item 18 of Table 5.1 of the Red Book) but I do wonder at the maths, if not the politics, behind all this: if memory serves, we have had several reviews of the non-dom regime over many years, that collectively decided it was broadly “a good thing” – or, at least, not “a bad thing”.

Crypto-Asset Reporting Framework – A consultation has been opened on how best to implement an extension of the OECD regime to require domestic reporting by exchange houses, etc., so that HMRC doesn’t have to keep issuing bulk information notices under FA 2011 Sch 23.

DIY Housebuilder Scheme – Enabling HMRC to require that documentary evidence be provided in support of a DIY Housebuilder claim, if and when HMRC wants to check a claim, now that the original claim is to be made online and without the need for records to be submitted alongside it, from Royal Assent.

Business Tax

Employee / Self-Employed NICs Main Rate to be reduced by 2% from 6 April 2024 – This announcement in particular was long-trailed in the press but is the most expensive measure here nonetheless, costing the Exchequer more than £10billions a year from 2024/25 (Item 1 Table 5.1, Red Book). Moreover it is, ostensibly, part of a long-term strategy (aspiration?) to do away with “unfair double-taxation of work”, according to the Chancellor… but the cost of doing so entirely would be enormous, unless he aspires eventually also to abolish the NHS, state benefits and Pension for which NICs are made, at least in spirit. Arguably, it no longer matters what pot you pay into as there are few constraints these days on how the Exchequer’s tax receipts should be applied. But if that be the case, then painting NICs as the villain of the piece is no more than pantomime. (I do also hope someone explains the implications of Secondary Contributions to the Chancellor at some point).

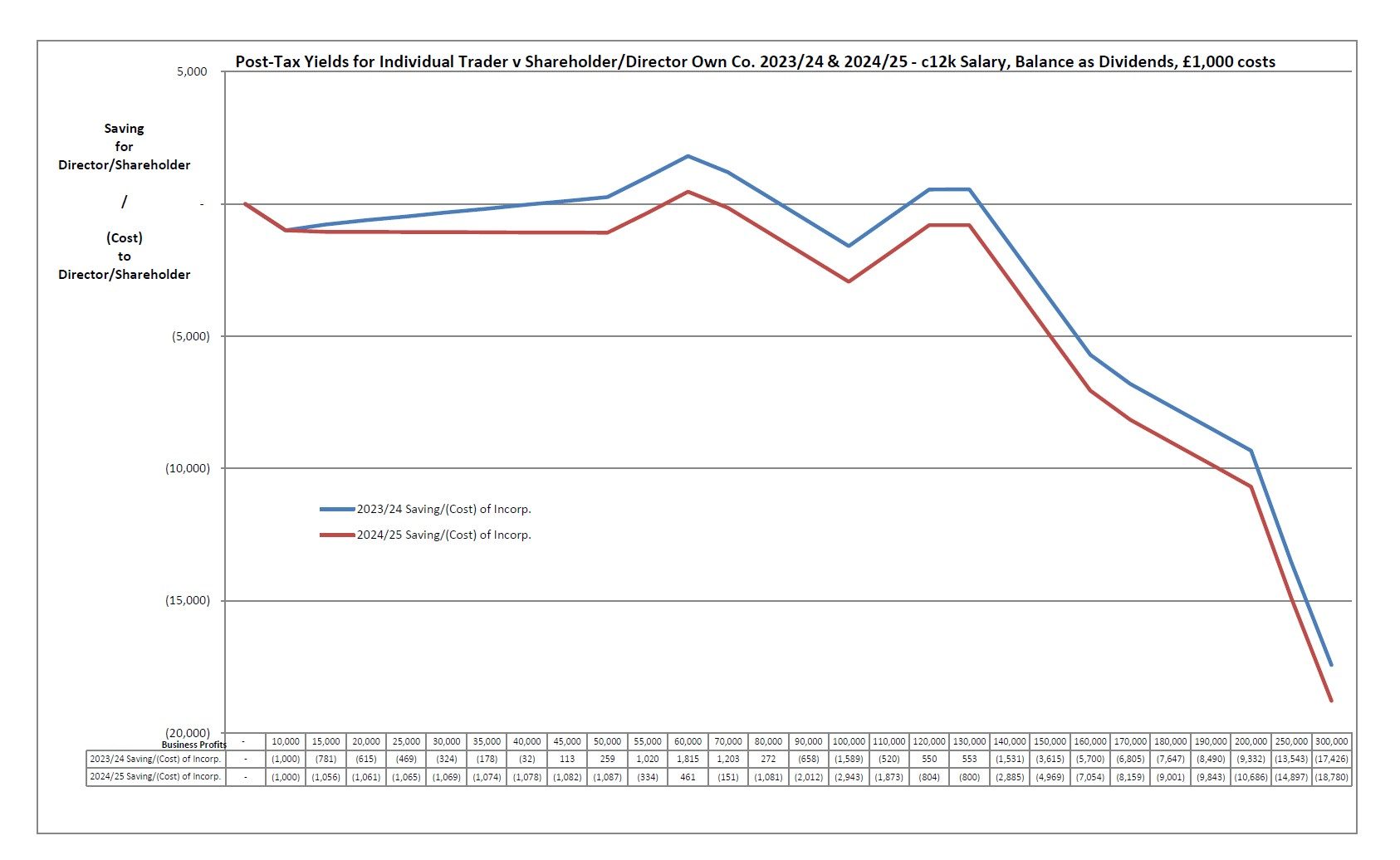

Implications for Incorporating One’s Self-Employed Trade Through a Company – Unsurprisingly, given that NICs have fallen significantly, the traditional modelling approach to incorporating a trading business has fallen rather flat. In the following model, that assumes it costs an extra £1,000pa to run a company when compared to the self-employed trade, (compliance costs, time/opportunity costs, etc.), the company alternative is almost always at a disadvantage, and that gets only worse at higher levels of annual profit. It can basically be said that, regardless of the scale of the business, there is no tax efficiency to be gleaned from incorporation, and potentially a significant and ongoing tax penalty for doing so. Of course this basic model takes no account of more nuanced circumstances, such as accumulating reserves in the company. Even so, these are strange times indeed where, for the self-employed at the typical Basic Rate level of profits, the cost of Income Tax + NICs is now almost exactly the same as the aggregate tax on post-CT profits paid out as dividends (using "Rest-of-UK" rates).

And if it looks like the tax efficiency of running a company is falling off a cliff as profits rise, then that's because it is (although do please note the profits interval has been compressed at the end - more for convenience, than dramatic effect).

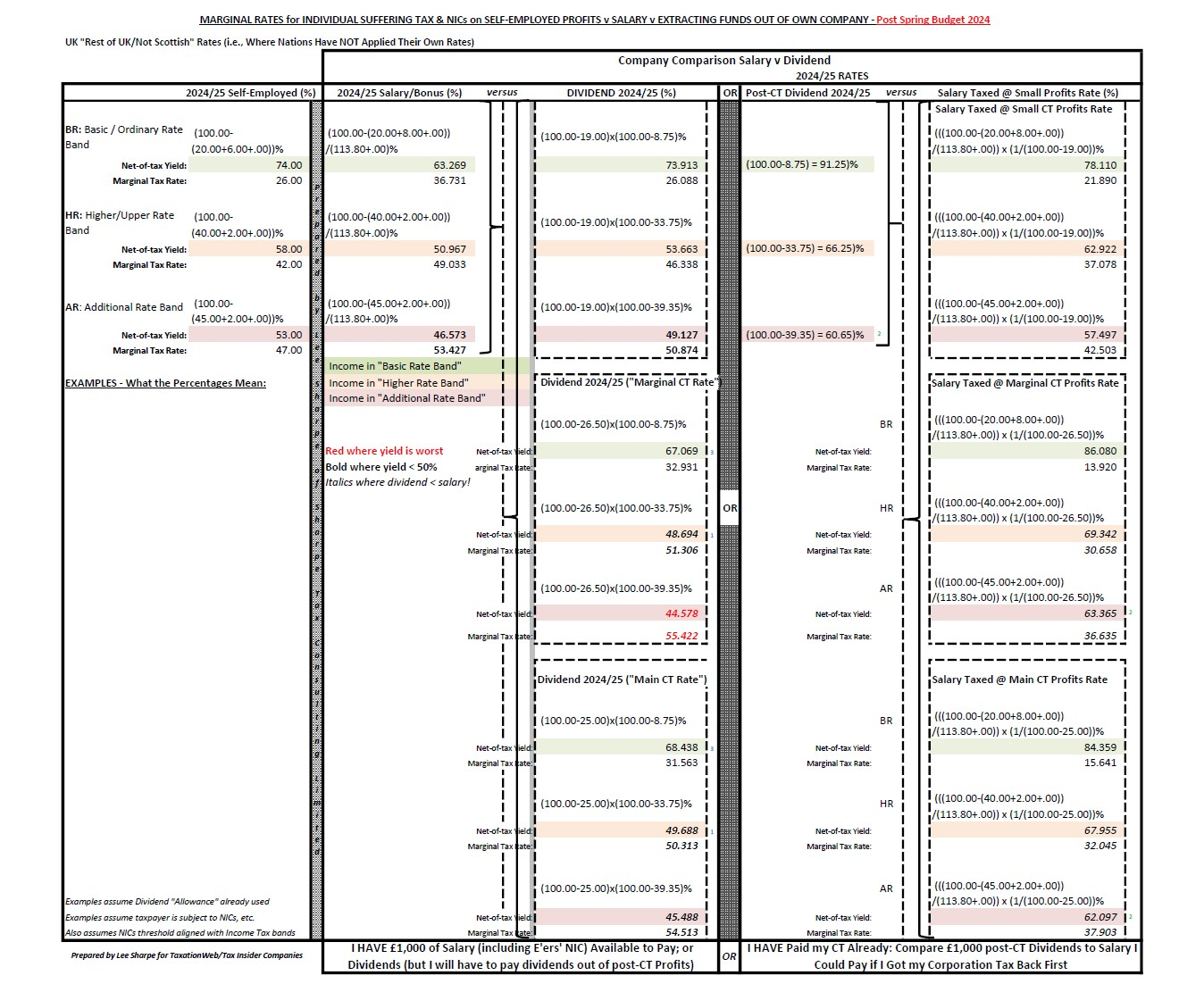

The Salary v Dividend Question – has also taken a further knock against the traditional assumption in favour of dividends. While the formerly safe haven of the Basic (Ordinary) Rate Band is still… relatively safe, it seems to me that there are in fact more comparisons now where dividend extraction is worse than salaries, at the margin, than the other way around (but please do not misread what I am saying here: I am not trying to suggest that it is now more likely than not that a bonus will be more tax-efficient than a dividend but that the number of basic permutations – as set out below and including those instances that are far less common – tend in favour of salary).

To summarise:

- It is no longer safe to assume that a limited company holds any annual profits tax-efficiency in favour of unincorporated businesses

- In fact, at the higher end of profit levels, (so to speak), it can start to cost thousands of pounds a year to run a business through a limited company – it is by no means revenue-neutral

- I continue to be amazed by the fact that this has been getting steadily worse for years, but very few people seem to have twigged: I have said before that a great many family-sized companies will have been paying for pandemic assistance that they never actually received in the first place

- The question of whether further profits should be extracted as a salary/bonus or as dividends (or as something else) becomes ever-more nuanced

VAT Registration Threshold increased from £85,000 to £90,000 from 1 April 2024 – for the first time in 7 years – that will, in the Chancellor’s own words, “encourage many more [businesses] to invest and grow”. Kind of makes you wonder why, then, this particular penny took 7 years to drop. Or rise.

Consulting on legislation for Full Expensing to apply to plant and machinery for leasing, “as soon as it is affordable” (which might well be never). The quite new Full Expensing of eligible plant and machinery is unlimited, but is of course available only to companies – unlike the Annual Investment Allowance, which is worth £1milionpa to most entities including partnerships, sole traders, etc.

Creative Industry Tax Reliefs

A number of measures were set out to secure and promote “the creative industries”, including:

- Audio-Visual Expenditure Credit – uplift by 5% to 39% for UK visual effects costs in film and high-end television productions, from 1 April 2025

- Visual Effects Costs – no longer subject to the 80% cap, from 1 April 2025

- Orchestra, Theatre, Museum and Gallery Reliefs – instituting permanent 45% higher rate reliefs for orchestras and touring theatres, musea and galleries, and a similar 40% uplift for non-touring troupes, etc., from 1 April 2025

- UK Independent Film Tax Credit at 53% for films with budgets under £15million that qualify under a new British Film Institute test – eligible expenditure from 1 April 2024, but claims from 1 April 2025

- 40% relief on gross business rates bills for eligible film studios in England, until 2034

Property Taxation

Capital Gains Tax on Residential Property: the (higher) higher rate is to be reduced from 28% to just 24% for disposals from 6 April 2024. “This will encourage landlords and second home-owners to sell their properties, making more available for a variety of buyers including those looking to get on the housing ladder for the first time, while also raising revenue over the forecast period,” says the Red Book. I am not so sure.

Let’s not forget that right now, and particularly in terms of property, CGT is pretty much a tax on the arithmetical difference* of inflation. For example, the RPI** in January 2024 is 378.0, while the RPI in January 2004 was 183.1, meaning that, by the traditional measure of inflation, prices generally have more than doubled in the last 20 years, while nobody is actually getting any the richer.

We know this. We have always known this, pretty much. Which is why we used to have Indexation Allowance, before it was stolen sorry, “simplified” away from us. I do not know many landlords who are unaware of the impact of inflation of on house prices. Moreover, the larger landlords such as housing associations are typically in companies, so are resolutely unmoved by a reduction in CGT rates (they pay Corporation Tax).

And let’s not forget that the standard CGT Annual Exemption has now been reduced to a paltry £3,000 from 6 April 2024 – likely because HMRC is desperate to prove its worth chasing down crypto-millionaires, after initially appearing quite happy to write the whole idea of crypto-assets off as akin to gambling, as per Revenue & Customs Brief 9 (2014)… what a difference a decade makes.

*Wilberforce LJ "To paraphrase a famous cliche, the Capital Gains Tax is a tax upon gains: it is not a tax upon arithmetical differences. (Aberdeen Construction Group Ltd. v. I.R.C. [1978] AC 885); also, "The Capital Gains Tax was created to operate in the real world, not that of make-belief" (WT Ramsay Ltd v IRC [1981] UKHL 1 (12 March 1981)).

**I look forward to hearing from pedants as to why the Consumer Price Index is a superior measure of inflation, for house prices.

Stamp Duty Land Tax Multiple Dwellings Relief to be abolished for transactions with an effective date from 1 June 2024 (even when purchases complete afterwards). Apparently, MDR was being abused. I couldn’t say, but I suspect some tribunal clerks will be doing cartwheels come June. Of course, high-volume acquisitions will – or should – still be able to rely on the “mixed use” adjustment for purchases involving 6+ properties. As well as a consistent approach to garden and/or grounds (I did say should). But, you know, baby steps.

Transfer of Assets Abroad and Limited Companies – For income arising from 6 April 2024, transfers involving close companies (or companies that would be close if UK-resident) will be caught by the “Transfer of Assets Abroad” anti-avoidance regime. I have a funny feeling that this may have been prompted by the CIOT’s paper of 26 January 2024 and discussion with HMRC. At least the Government didn’t try to pass this off as a “clarification”, but if this is the kind of thing that is supposedly propping up “the Tax Gap”, then I have questions about what else HMRC thinks belongs in there.

Furnished Holiday Letting Regime to be abolished from 6 April 2025. The regime was basically hollowed out from 2011 by removing the favourable Income Tax loss treatments and hiking the qualifying period criteria by 50%. The quasi-trading CGT and pension treatments may be missed by some, but not by many, given the relatively small savings HM Treasury forecasts at item 16 of the Red Book’s Table 5.1.

First-Time Buyers’ Relief – effective from 6 March 2024, first-time buyers of new residential leases via nominee or Bare Trust will be eligible for the Relief in their own right. The rationale is to allow victims of domestic abuse to acquire a new home using a nominee, etc., without the beneficial owner’s details being potentially available to other parties, but still secure the relief available to others.

IHT Agricultural Property Relief and Woodlands Relief to be restricted to UK-only sites for transfers from 6 April 2024. This was previously trailed in Spring Budget 2023, but the papers have been updated. Another “Brexit Bonus” that nobody asked for, far less actually wants.

HMRC Powers and Administration – “We’re Waving, Not Drowning”

Debt Collection – “…I will provide HMRC with the resources they need to ensure everyone pays the tax they owe leading to an increase in revenue collected of over £4.5bn across the forecast period”, said the Chancellor. We know that HMRC is in a parlous state, despite its executive’s confident reassurance that they are “waving, not drowning” under a rising tide of taxpayers. I am not sure that debt management should be the priority, and it is unclear from Table 5.1 of the Red Book how much is actually being invested, to reap such rewards.

IT and Artificial Intelligence – Moving on, the Chancellor seems to have been bitten by the AI bug. There was talk of an IT and AI-led revolution across broadly all government departments. HMRC was not mentioned, and I infer that this is because HMRC is already well on its way. The idea that HMRC, in its current condition, is intent on using AI as a means to accelerate processes or to replace technical acumen, is the kind of thing that keeps me awake at night. Information Technology is an oft-brittle tool, not Panacea herself, in binary finery. I am old enough to remember when the WannaCry virus brought the NHS to its knees in 2017 – staff couldn’t even use hospital telephone systems, and had to use personal mobiles and paper records – and it was only by sheer luck that the situation did not get far worse.

Raising standards at HMRC – nope, sorry, mis-read that as usual – in the tax advice market, by posing a consultation on:

- Exploring mandatory membership of a professional body in order to give tax advice

- Strengthening controls on access to HMRC’s agent services

Having dealt with numerous practitioners over the years who are undeniably competent without formal qualifications, I am wary of (1). Even so, I should wholeheartedly embrace that option if HMRC’s own staff were likewise obliged to attain similar technical standards to those acting in the profession – independently assessed, naturally.

Option (2) will allow HMRC to identify and track agents, as they communicate increasingly online and their Agent Reference Number will be intrinsic to online access and standardised correspondence presumably so that HMRC will be able to identify bad actors more quickly. My concern here is if HMRC becomes judge and jury as to who is a “bad actor”.

Conclusion – The Death of the Family Company?

Probably not – or at least not yet, particularly with Disincorporation Relief having been withdrawn long ago (basically, safely before it was actually needed). But they could be put out to pasture. I suspect that the director/shareholders of a great many OMB companies will not need me to tell them that their tax bills have risen significantly in the last 5 years or so, as "reforms" have trickled through to reckoning, under Self Assessment. But I should warn there is worse to come for some director/shareholders, who will not yet have felt the full force of the hike in Corporation Tax rates, starting 1 April 2023. Advisers have spent the last 20 years or so dealing with "should we be in a limited company?"; soon the more common question may well be "should we get out?".

More widely, it was a long speech, but little was actually said – apart from the changes to NICs and Non-Domicile treatment, there were few major developments, and the net effect of the Budget, supposedly at £6.5billion in favour of the taxpayer, seems like it will hardly touch the sides.

Over the last few Budgets, we have seen:

- Corporation Tax cuts reversed

- Dividends progressively squeezed

- Capital Allowances, that had previously been repeatedly pruned back, now revitalised

- Child Benefit Clawback significantly constrained

Perhaps this is not so remarkable and is simply a function of time (or advancing years), but I am not sure how many flagship policies of the early 2010s are left, aside from pensions reform. (And in similar vein, it seems to me like little more than a year ago that the Government was threatening to add a pretty substantial Health and Social Care Levy onto NICs, rather than profess a yearning to abolish NICs altogether... I must have dreamed it all.) In some respects this is meet: some were clearly stupid, and borne of ideology (and in at least one case, downright bloody-mindedness). But the inexorable squeeze on family companies that started in July 2015’s Summer Budget continues. We are certainly a very long way now from small companies paying 0% Corporation Tax on the first £10,000pa in profits. No doubt some will argue that this, too, is meet.

Elsewhere, the suggestion that, from April 2026, HMRC should be put in charge of monitoring family-wide income – ostensibly just to ensure that the Child Benefit regime is working fairly – is very concerning. HMRC will be having a peek through your hedgerows to hector your household in no time at all. I cannot see that ending well. Or, for the more mathematically disposed, where IT = Information Technology:

(Farce x IT)AI = Tragedy

Please register or log in to add comments.

There are not comments added